“ Interested in the renewables sector? Morgan Stanley says… Now please excuse my improper pronunciations of company names in these quotes from this article.

Here’s the first titled, Following COP26? Look at These 3 Sustainable Investing Strategies and 40 Stock Picks. Several of today’s articles relate in some way to COP26. Great Stock and Fund Picks Post COP26 (1)

Please note, I receive no compensation from Morningstar or anyone else covered in these podcasts.Īlso, if any terms are unfamiliar to you, simply Google them.

#Nasdaq xel for free

If your broker doesn’t have this information, signup for free with Morningstar and you can gain access to company and fund ESG-sustainability ratings. Furthermore, if you’re concerned about the ESG and sustainability ratings of any stock or fund included in this podcast, check your broker’s online site for such information. I do not evaluate any of the stocks or funds mentioned in this podcast. Remember that you can find a full transcript, links to content – including stock symbols, quotes, and bonus material – at this episode’s podcast page located at /podcasts. is your site for vital global ethical and sustainable investing news, commentary, information, and resources.

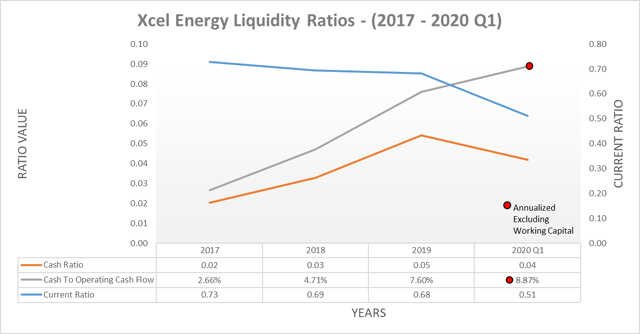

Welcome to podcast episode 71 published on November 19, titled “Great Stock and Fund Picks Post COP26” - and presented by Investing for the Soul. Transcript & Links, Episode 71, November 19, 2021 Great Stock and Fund Picks Post COP26 include Tesla, NIO, Li Auto, TPI Composites, Schneider National, Knight-Swift Transportation, FREYR, Fisker, Alstom, NARI Technology, SINOPEC Engineering Group, Covestro, Rexel, Ørsted, Siemens Energy, FirstEnergy, Sunrun, PAVE infrastructure ETF, Parker-Hannifin, Xylem, Jacobs Engineering, Martin Marietta, Cleveland-Cliffs, Xcel Energy, United Rentals, VOTE ETF, Plug Power Inc., Brookfield Renewable Partners PODCAST: Great Stock and Fund Picks Post COP26

0 kommentar(er)

0 kommentar(er)